![]()

Trade to your "Targets "

"

Fast, Risk-Managed Futures Trade Execution

Do you have different core or “target” portfolios you like to hold under various market conditions, but find yourself manually trading to them because you have no automation options?

Have you made a habit of jumping into positions quickly to make sure you get into the market, only to realize afterwards that your position sizes are too large or small?

Automation isn’t just for algorithmic traders. Automation can help manual traders quickly align their positions to the current market environment, whether they are reacting quickly to market data or breaking news.

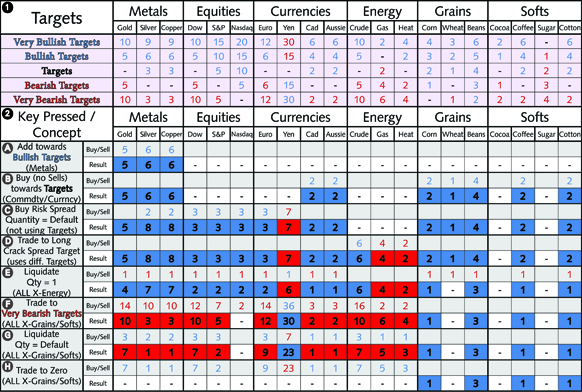

Keyboard Trader's target trading functionality is designed to help you improve your speed and risk management using sophisticated and highly configurable algorithms. See target trading in action in the table below:

- In Section 1, an example set of bullish, bearish, and neutral targets are provided.

- In Section 2, first view the "Key Pressed / Concept" in the left column for each example A-H, and then look to the rest of the table on the right to see the actions taken by Keyboard Trader.

See how target trading can help you execute fast, risk managed trades in different scenarios: